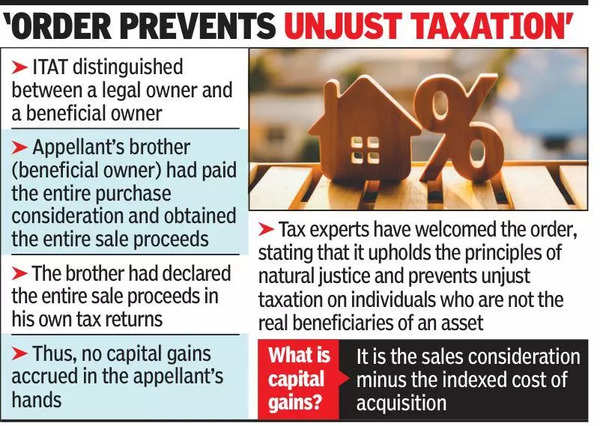

MUMBAI: In a significant decision, the Income Tax Appellate Tribunal (ITAT), Mumbai bench, distinguished between a legal owner (an individual whose name is merely added on purchase of a property, say a spouse or brother) and a beneficial owner (to whom it actually belongs).

The ITAT emphasized that merely having a name on a property title does not necessarily confer ownership if there is clear evidence to the contrary. Thus, on sale of the property, where the proceeds flow solely to the beneficial owner, the individual whose name has been merely added is not obliged to pay tax on capital gains.

Often, when a property is purchased, the name of another family member is added out of ‘love and affection’ – such as to provide a degree of security to a spouse. However, on sale of such property, tax demands are raised even on the legal owner for his or her share of capital gains tax. This ITAT order in the case of V N Jain will benefit taxpayers facing a similar situation.

In this case, V N Jain held a property jointly with his brother, which was sold for Rs 54 lakh during the financial year 2014-15.

The Income-Tax (I-T) officer observed that there did not exist any family arrangement under which Jain has relinquished his right to the property prior to the sale. Thus, he held that Jain’s share of the sale proceeds of Rs 27 lakh would be taxable in his hands as capital gains.

Capital gains is the sales consideration minus the indexed cost of acquisition. When Jain filed an appeal, the appellate commissioner granted a partial relief by holding that capital gains should be computed after deducting the proportionate share of cost of acquisition of the property from the sum of Rs 27 lakhs. Capital gains tax would be payable only on the net sum arrived at. Jain then approached the ITAT.

Before the tax appelate tribunal, he submitted that the property sold was originally purchased by his brother, who had full possession and rights over it. His name was added as a joint owner out of natural love and affection. The ITAT bench reviewed the evidence submitted such as purchase deeds, and the brother’s bank statement. It also observed that the brother had declared the entire sale consideration in his own I-T returns.

The ITAT observed that Jain had neither paid for the property nor received any proceeds from the sale. Thus, no capital gains tax liability could be imposed on him.

Tax experts have welcomed the order of ITAT, stating that it upholds the principles of natural justice and also prevents unjust taxation on individuals who are not the real beneficiaries of an asset.