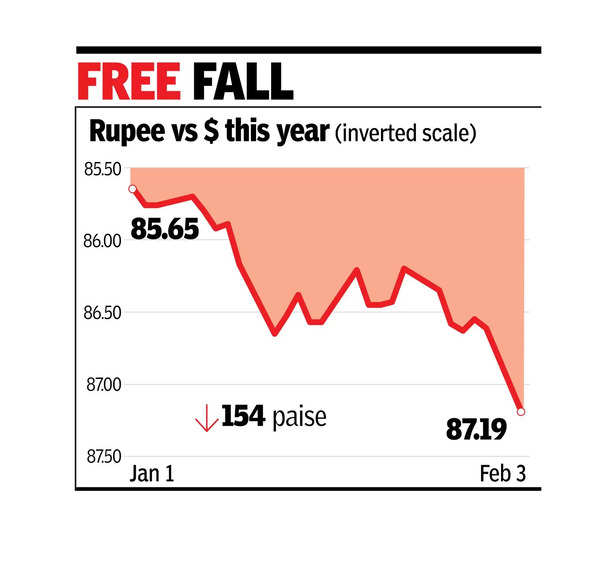

MUMBAI: Rupee hit a record low of 87.28 on Monday, following US President Donald Trump’s announcement of tariffs on imports from major trade partners that has sparked fears of a trade war. It closed at 87.19, down 58 paise from its previous close, marking its largest single-day drop in two weeks.

Rupee might have weakened further had RBI not intervened through public sector banks. Some dealers speculate RBI is letting the rupee adjust in line with other Asian currencies. Along with Asian currencies, the Mexican peso dropped more than 2%, hitting a nearly three-year low.

Sensex dropped by 319.2 points (0.41%) to 77,186.7, and the Nifty index fell by 121.1 points (0.52%) to 23,361. US tariffs are expected to dominate currency market trends this week. Analysts see a negative bias for the rupee due to the strong dollar, worsened by foreign institutional investors continuing to sell equities.

FPI net sales amounted to Rs 1,327 crore. The dollar index rose 1.01% to 109.46, while Brent crude gained 1.41%, priced at $76.74 per barrel.

“Investors are now worried about how US tariffs will affect global trade, with countries shifting towards more bilateral deals. There’s also a chance that negotiations could lead to lower tariffs. As new information emerges, the dollar may oscillate, possibly reaching 114 before pulling back. However, if investors realise these tariffs could hurt both other countries and the US economy, the dollar could weaken,” said Ashhish Vaidya, head of treasury at DBS Bank.

“The question is how much lower the rupee can go. It depends largely on what RBI will do. There is already panic, with importers rushing to book dollars, thus increasing demand. Will RBI sell dollars now, or let the market decide?” said Madan Sabnavis, chief economist at Bank of Baroda. Sabnavis noted that managing rupee movements with liquidity is tricky, as selling dollars would drain liquidity. “All eyes are on RBI now for monetary action,” he added.

Meanwhile, the Canadian dollar dropped to its lowest level since 2003, and the euro neared parity with the dollar. Trump also hinted at tariffs on European goods, leading to a global stock market downturn. Bitcoin prices fell, while crude oil prices gained, and industrial metals suffered losses.